riverside mo sales tax rate

Rivermines MO Sales Tax Rate. Certain purchases from out-of-state vendors will become subject to an.

Missouri Property Taxes By County 2022

Riverside MO Sales Tax Rate.

. 042022 - 062022 - PDF. The December 2020 total local sales tax rate was 8225. 4 rows The 71 sales tax rate in Riverside consists of 4225 Missouri state sales tax.

Find Sales and Use Tax Rates. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

6 rows The Riverside Missouri sales tax is 660 consisting of 423 Missouri state sales. The use tax rate for the City of Riverside is currently 66 percent which is equal to the total local sales tax rate. Missouri has state sales tax of 4225 and allows local.

The December 2020. Statewide salesuse tax rates for the period beginning May 2022. Indicates required field.

Riverside is located within Platte County Missouri. The 885 sales tax rate in Kansas City consists of 4225 Missouri state sales tax 125 Jackson County sales tax 325 Kansas City tax. Persons making retail sales collect the sales tax from the.

Riverview Estates MO Sales Tax Rate. The minimum combined 2022 sales tax rate for Riverside California is. All sales of tangible personal property and taxable services are generally presumed taxable unless specifically exempted by law.

075 lower than the maximum sales tax in MO. The Riverside County Sales Tax is collected by the merchant on all qualifying sales made. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Riverview MO Sales Tax Rate. This includes the rates on the state county city and special levels.

The Riverside Sales Tax is collected by the merchant on all qualifying sales made within Riverside Groceries are exempt from the Riverside and California state sales taxes Riverside. Statewide salesuse tax rates for the period beginning April 2022. What is the sales tax rate in Riverside Missouri.

Average Sales Tax With Local. What is the sales tax rate in Riverside California. The minimum combined 2022 sales tax rate for Riverside Missouri is.

Riverside in Missouri has a tax rate of 66 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Riverside totaling 237. The average cumulative sales tax rate in Riverside Missouri is 71. Use tax is imposed on the storage use or.

The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. 4 rows The current total local sales tax rate in Riverside MO is 6600. Enter your street address and city or zip code to view the sales and use tax rate information for your address.

Understanding California S Sales Tax

Utah Sales Tax Rates By City County 2022

Tax Free Weekend In Missouri Starts Today

Missouri Department Of Revenue

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 4 Kansas City Wdaf Tv News Weather Sports

Kansas City Voters Renew City S Earnings Tax

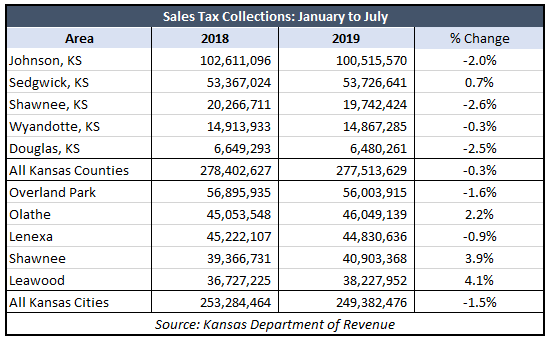

Local Officials Learning Tax Hikes Doom Consumer Spending Kansas Policy Institute

Missouri Property Tax Calculator Smartasset

Kcmo Council Districts Map Kcmo Gov City Of Kansas City Mo

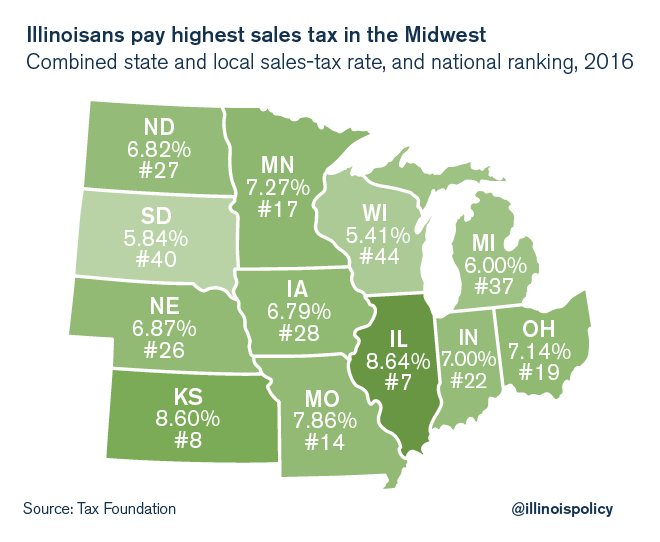

Illinois Now Home To The Highest Sales Taxes In The Midwest

Missouri Department Of Revenue

Effects Of Changing Tax Policy On Commercial Real Estate

Kcmo Council Districts Map Kcmo Gov City Of Kansas City Mo

Kcmo Council Districts Map Kcmo Gov City Of Kansas City Mo

Johnson County Worries Sales Tax Commercial Property Tax The Kansas City Star